This is the once-a-week free edition of The Diff, the newsletter about inflections in finance and technology. The free edition goes out to 9,159 subscribers, up 275 week-over-week. This week’s subscribers-only posts:

- Equilibria aren’t endpoints: investors like to choose a price target when they enter a trade, but a price target implies that there’s a future steady state where some uncertainty has vanished. At that future point, though, it usually turns out that there are new sources of confusion—and sometimes, price itself drives changes in fundamentals.

- Minimum, Viable, and Not Even a Product: do you need to launch a product before you start selling it? Should you? Several case studies say no.

- A Uranium Shortage, Someday: I take a look at the supply of uranium, the demand for uranium, and how shortages get resolved. As a bonus: power plant economics make uranium a bet on interest rates.

- If Y Combinator is the New College, What’s the New Y Combinator?: Y Combinator has the most enviable kind of problems—the ones that arise from being successful, and then being known for success. What comes next will look like what came before.

In this issue:

- The Bullwhip Effect

- State Capacity Liquidationism

- Hong Kong: Still a Financial Center

- More of the Infrastructure Long Game

- Big Tech Plays Hardball With Big Data

The Bullwhip Effect

The bullwhip effect is the observation that a small change in demand can lead to much larger changes down the supply chain. Just like a small flick of the wrist can make a whip crack, a small change in consumer behavior is magnified at the supplier level, magnified again by their suppliers, and again down the line.

To take a naive example, suppose there’s a sudden increase in demand for, I don’t know, toilet paper.

- The retailers notice that they’re out of stock. Toilet paper demand has doubled, and the variance in that demand is up, too. They don’t ever want to be out of stock—toilet paper being one of those products where, if a customer comes to the story looking for exactly that, said customer will be quite disappointed to leave empty-handed. So, to be safe, they triple the amount they keep on hand, and thus triple their orders.

- Toilet paper manufacturers see their orders tripled. Now they’re out of stock. Demand has tripled, and the variance is up. They know that being unreliable suppliers is bad for business, so they quadruple their usual wood pulp order, and buy more factory equipment to accommodate the increase in demand.

- Further down the line, more trees get harvested, so more trees get planted; more equipment gets bought, so the capital goods companies that supply toilet paper factories with their equipment staff up, increase orders to their suppliers, and so on.

And then, a month later, everyone has as much toilet paper as they need, it’s still on the shelves, so demand plummets. Now all of these effects run in reverse: the toilet paper factories cut their orders to fiber suppliers and cancel their equipment orders; the wood product companies have a glut of inventory and more workers than they need, so they lay people off; same for the capital goods companies.

That’s an extreme example; the numbers are illustrative, but directionally correct. This kind of thing happens all the time in supply chains—and supply chains are a more ubiquitous concept than you’d think.

I use supply chain metaphors a lot. I’ve written about the supply chain of software exploits and of devious trading talent, the supply chain of journalism, the supply chain of résumés, the supply chain of data, and countless actual supply chains.

It’s a powerful metaphor because a supply chain describes any system where:

- There’s some demand for a final product that doesn’t exist in nature,

- Creating that final product requires some inputs that do not exist in nature, and

- The various inputs at stage 2 have different levels of information asymmetry, elasticity, policy/PR importance, and duration.

It’s the variances that make bullwhip effects so interesting. On duration, for example, you can code up a simple simulation of a cyclical industry if you assume that demand for the end product varies on a shorter time-scale than supply, and that everyone who can create supply has a slightly different approach to anticipating future demand. The cruise ship industry is a classic example. It takes roughly seven years to go from “I think I’d like to purchase a brand new cruise ship” to having a ship set sail full of paying customers. So all the ships that were slated to be finished in 2020 were first conceived based on demand in 2013. The cruise lines themselves are volatile (Carnival’s revenue was down 85% Y/Y last quarter), but the shipbuilders are more volatile still. In that same quarterly release, Carnival said that 2021 cruises were being priced at low- to mid-single-digit percentage discount, but that booking volumes were in line with the normal range. So they’re expecting revenue to recover soon, but it’ll be a long time before they feel the need to order additional ships.

Information asymmetries also apply. Most companies are tight-lipped with suppliers; any information you share with a counterparty improves their negotiating position, so the default is to not give up much at all. Supply and demand elasticity vary at different points in the supply chain, for different participants. If one of Nike’s contract manufacturers raises their prices 5%, Nike can use somebody else. If Nike raises their prices 5%, that’s the new price for Nikes.

Of course, it’s possible to extrapolate too far.

The bullwhip effect is a rare case where taking the analogy completely literally is actually useful. One might ask: if the bullwhip effect is a function of a) long supply chains, and b) counterparties who don’t share information, then the far reaches of complex supply chains should be very volatile indeed. Auto parts companies, drilling equipment manufacturers, and semiconductor capital equipment companies should always be in a state of boom or bankruptcy. Those businesses are volatile, but not that volatile.

Why not?

The bullwhip effect with a literal bullwhip gets more pronounced as the whip gets longer, at least for a while. Eventually, gravity predominates, and the effect peters out. For suppliers, the two kinds of “gravity” are a) common-sense judgment (if a 20% jump in demand percolates through ten layers of the supply chain, rising 20% each time, it ends with a 520% increase in demand. But nobody expects demand to be that volatile, so in practice the magnitude of the mistake should diminish as it passes through more levels of the supply chain). The other force of “gravity” is that, as you get closer to the end of the supply chain, you’re more likely to be dealing with multi-use raw materials.

An increase in demand for soda might lead to an increase in demand for soda bottles, meaning an increase in demand for plastic, causing an increase in demand for oil. But while there aren’t many alternative uses for a plastic-bottle factory other than making plastic bottles, there are many uses for plastic itself, and many more for oil. So as the supply chain gets closer to stuff that grows on trees or gets dug out of the ground, the effect is muted because most of those things are multi-use.

Not all, though! 88% of rhodium is used it catalytic converters, so it’s fully subject to the vagaries of the bullwhip effect. Here’s what that looks like:

(Via TradingEconomics.com)

I’ve talked about lots of literal supply chains in the above explanation, but the concept applies much more broadly than that:

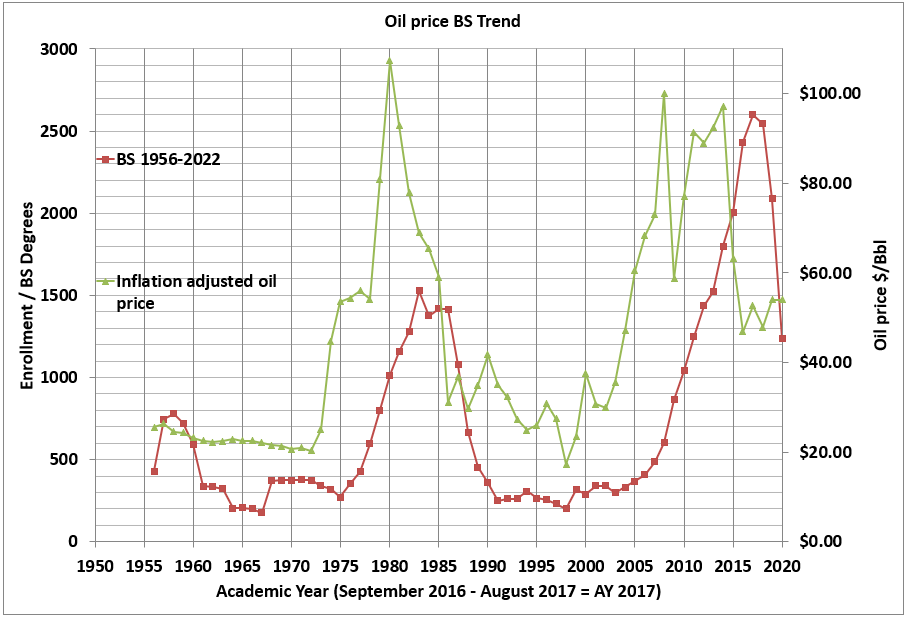

There’s a supply chain of talent, because it takes time to develop the skills and connections necessary to do specific jobs. But the economic rewards of those jobs can change faster than it takes to get a degree and start your career. For example, here’s a chart of petroleum engineering compared to oil prices:

It’s a perfect case study: a massive drop in oil predicts an increase in graduates, because the majors are a lagging indicator. But to the unfortunate engineering majors who graduate during a bust, not only are there fewer jobs than usual, but there’s a whole lot more competition.

There’s a supply chain of dollars, which is especially important in developing markets. Dollar financing is often cheaper than local currency financing, even adjusting for inflation (that’s the flip side to the currency carry anomaly, that buying high-yielding currencies tends to generate good risk-adjusted returns). But that means that every developing country needs to continuously acquire dollars, either through exports, through rolling over debt, or in extreme situations through the Fed’s dollar swap lines. But all of those have different durations: central banks work with other banks, not corporations, so if a company in the developing world runs out of dollars, it has to ask its bank, its bank has to ask the country’s central bank, and that central bank has to ask the Fed—meaning there are layers of business risk and political risk that are completely opaque to the end user of the dollars in question.

There’s a supply chain of opinions: some writers are widely-read but rarely-cited, usually because they have some combination of many good ideas and a poor filter for bad ideas. Mildly partisan syndicated columnists partly exist to launder good ideas from unpopular people into the wider discourse.

There’s a supply chain of hiring and management methodologies, which works like this: when a small company starts to scale, it needs to hire lots of talent, fast. It’ll often find one good person from an established firm, and that person will bring in all their smartest friends. And suddenly, the interview process at NewCo.io is exactly the same process Google or Microsoft or Amazon had five years earlier, when NewCo.io’s brand new VP of Eng. got hired as an engineer there. This, of course, just accelerates the acculturation process. If your friends from Google start to leave for somewhere cool, a) you’ll hear about it, and b) since you got through the Google hiring process, you’ll probably ace the same process there.

Even this newsletter has a supply chain. I have some inputs that are capital goods—mental models like “What options trade is this decision most similar to?” or “What information/incentive asymmetry explains this?” or “What if the causation is backwards?” or “How is this process like a supply chain?” Some inputs are random gushers of good ideas, mostly conversations, especially the arguments. Reading a book is practically guaranteed to produce an idea or two for a newsletter writeup, but it takes time. Some sources are inexhaustible mines with low-quality ore; the vast majority of news stories are worthless, but read enough of them and good ideas show up. And of course there’s the short-duration input of writing time. (That one’s easier to get than it looks: when I had normal jobs, I was always far more productive in the last 12-24 hours before a deadline, so a daily newsletter just means structuring my life so I’m always in a situation of maximum productivity.)

Supply chains are everywhere, which means bullwhip effects are everywhere, too. If you have perfect information, you can react sensibly to changes in the real world. But if your information consists of other people’s reactions, it’s worth asking: will everyone misread things in the same direction?

A Word From Our Sponsors

Versett creates, builds and scales technology companies.

Each month, millions of people use the platforms, apps and tools we’ve developed for clients like American Express, TD Bank, and Lincoln Financial. But it’s not just the technology. Most of the value of new digital initiatives accrues after launch—so we help you build internal teams to operate and scale productively. The result? Successful launches, clear roadmaps, pragmatic hands-on help.

Versett is different. Take a deeper look at how we work at http://versett.com/thesis

Elsewhere

State Capacity Liquidationism

Tyler Cowen likes the term state capacity libertarianism to describe people who trust markets, but believe there are some things governments are theoretically better at, and that governments should be entrusted with if they’re practically better, too. Dealing with externalities, paying for pure research, enforcing laws—all things an optimal government can probably do better than an optimal market. State capacity libertarianism implies that one should be more libertarian in places with incompetent governments, and more accepting of state intervention when the state has its act together.

I thought of this a lot when I read that even if $600/week supplemental unemployment gets passed before the 7/31 deadline (unlikely), the updated policy can’t be implemented in time to get checks to unemployment recipients. The infrastructure for processing claims, setting payments, and getting them to recipients is just too clunky.

This brings up all sorts of questions, like:

- We knew in March that the deadline for either ending supplementary unemployment benefits or modifying them was in late July. Programmers can work from home. Did anyone plan for this?

- New Jersey was hiring Cobol programmers in April. Did they fix anything?

- Is there a roadmap for rebuilding these systems in a more maintainable way?

If you’re a resolute political moderate, this is all very exciting news: the country literally doesn’t have the technical chops to implement something like Basic Income, an unemployment rate- or infection rate-based safety net, online voting, or digital IDs. On the other hand, other countries clearly can do this kind of thing, so it’s a form of meta-pessimism, arguing that all the countries with good execution skills have terrible ideas, and vice-versa.

Hong Kong: Still a Financial Center

In the wake of Hong Kong’s new national security law, and the attendant social unrest, Hong Kong’s monetary authorities have had to intervene—to keep the currency down. Hong Kong has received dollar inflows, mostly because of blockbuster IPOs. Some of this may be an artifact of two coinciding trends: China’s equity bubble, and Hong Kong’s new status as part of China but a dollar-linked part of China.

More of the Infrastructure Long Game

I wrote last week about Japanese companies investing in LNG facilities in Bangladesh. The first-order effect is bad for Japan, the world’s largest LNG importer. Why subsidize a competitor? But the second-order effect is good: countries with cheap capital have a comparative advantage in backing infrastructure, and building infrastructure in poor-countries-that-aren’t-China is a way for Japan to move its supply chain out of China. It’s happening again, this time in Myanmar. (This deal is a bit over 3x the size of the Bangladesh deal.)

The extent to which Japanese multinationals are behaving as profit-maximizers versus geopolitical strategists is always debatable. But in a country with a bank-heavy financial system and very low interest rates, these amount to the same thing: the longer your outlook, the more international relations figure into it. And the more dependent you are on banks, the more your investments ultimately reflect the priorities of those banks' regulators.

Big Tech Plays Hardball With Big Data

The Information has an exposé of Google’s use of Android data to launch competing products, and the WSJ has one about Amazon using data from startups it negotiated investments with to launch competing products. The timing of the Google and Amazon stories must come as a big relief to PR people at Amazon and Google, respectively.

Both cases look like extreme expressions of each company’s corporate culture. Amazon loves to compete ruthlessly, and wants to have a good product in every category, so of course their corp dev team can also serve as a part-time corporate espionage team. And Google just loves to collect data, and then use it to improve their products. Whenever companies get big, they run into this kind of potential conflict: one part of the company needs information for sensible business reasons, but another part of the company wants exactly the same data to kneecap the competition.

(Disclosure: I’m long Amazon, but for boring AWS-related reasons rather than swashbuckling info-piracy reasons.)

In more innocuous Amazon news: the company is now offering car insurance in India. As with other product launches in India, they have a local partner. Now that China’s suddenly a riskier growth market, India is every big tech company’s favorite long-term emerging-market bet. But India has a protectionist tilt (a bit more decentralized than China’s, but restrictive nonetheless). This means that every India-based company has an invisible asset on its balance sheet: the ability to provide regulatory cover for a multinational tech company that wants to test out new products in the other rapidly-growing economy with over a billion people.

Byrne Hobart

Byrne Hobart