Attention conservation notice. This jeremiad is all about financial policy, which I know is not a topic all of my readers are interested in. This piece is only relevant to you if you own a home in the US (because mortgage rates matter) if you rent in the US (because market rents are set in comparison to the cost of owning), or if you save and/or borrow money anywhere in the world (because of the US mortgage system’s effect on long-term interest rates. Readers who live in monasteries, survivalist compounds, or the Sentinel Islands can safely skip this one.

The thirty-year fixed-rate prepayment-option mortgage is an economic disaster. It encourages mass malinvestment. Policies designed to help low-income people build wealth actually trap them at the worst possible time. It presents macroeconomic risks (as we learned in 2008), but those risks are artificially understated due to the behaviors of lenders. And it artificially raises the volatility of one of the most important economic indicators in the world, leading to excess volatility and worse investments globally.

I’ve always suspected that our mortgage system had bad effects, but it wasn’t until recently that I dug in and realized how truly bizarre the system was. A realistic summary of the American housing finance ecosystem is that most of it has been socialized: while we spend some money on public housing for the poor, we invest vastly more in hybrid public-private housing for the middle class; the capitalist part is what happens if your house goes up in price, and the socialist part is what happens if it doesn’t.

Illustrative diagram: housing as an asset class (top) and the financial underpinnings of its future price appreciation.

If you look at the history of American deregulation, the worst results come from these Frankensteinian combinations of an unfettered free market with a regulatory maze and torrents of public money. Electricity deregulation in the 90s fits this template, as do both S&L crises — the one we got when the S&L industry was mostly insolvent because they owned long-term assets yielding 5% at a time when short-term treasuries paid 15%, and then the one we got a decade later when we solved the first crisis by letting them grow their way out of the problem.

I don’t think we’re set up for a replay of 2008. We’ve learned a bit since then, and some excesses of the system have been tamped down. But our current system does create needless poverty, needless speculation, and needless volatility. Also, I suspect it’s almost impossible to fix.

The Mortgage Bet

A residential mortgage is a financial instrument. That is, it’s a bet on several factors. Let’s go through each in turn, from smallest to largest:

- A mortgage is a bet on the value of a specific home: it’s a bet that you won’t burn your house down, turn it into a meth lab, or otherwise diminish its value. In some cases, a mortgage is implicitly a bet that you’ll fix things up a bit, but a responsible lender won’t lend against the expected full value of yet-to-be-improved collateral.

- It’s a bet on local real-estate prices. Crucially, this means a mortgage is a bet on the local labor market. What determines rents is is the availability and median wage of jobs. (Exhibit A: the Bay Area. Exhibit B: Detroit.) If you consider the typical consumer’s theoretical balance sheet, the single biggest item on that balance sheet is the net present value of their future wages: unless you’re quite late in your career or made some very savvy trades, this dwarfs your savings and investments. From the consumer’s perspective, this asset is very hard to hedge: if your savings are in stocks, you can sell stocks or buy put options; if your net worth is the net present value of the next 30 years of your earnings as a radiologist or car mechanic, there isn’t a trade you can make that pays off directly in proportion to how much those wages drop. And due to Baumol’s cost disease and the Alchian-Allen effect[1], your wages will have a location-based premium that’s also hard to hedge. Whatever you do for a living, you’ll be doing it for more money in Manhattan than in Montana.

- A mortgage is a bet on interest rates, but it’s an esoteric one. If a company borrows money for 30 years, they can often pay it back at any time, but if rates have dropped (and thus the present value of that bond has risen), they’ll have to pay it back at a premium. For example, suppose a company borrows at 4% for 30 years, and the next day the prevailing rate is 3%. To buy back that bond, they’d need to pay about 120 cents on the dollar. Not so for a mortgage borrower: the borrower has the option to refinance their mortgage if rates move to their advantage, but can keep the mortgage if rates rise. Essentially they have an embedded option. Depending on the volatility of interest rates, this can be quite valuable. Certainly, the paucity of companies making this bet implies that it’s not the approach everybody chooses when they’ve done the math.

So the default life path for the ~2/3 of Americans who own their homes is to borrow a bunch of money to double-down on a bet they didn’t even want to make in the first place, and it’s coupled with an interest rate option.

Now, one might argue that this is the obvious right way to do things, but one would not be thinking very hard. Most people don’t stay in one home for thirty years, so the term of the loan doesn’t match the underlying transaction. Most consumers don’t think to themselves “I expect rates vol to rise in the future, so I’d better be long gamma right now.”

And most consumers don’t structure elaborate derivatives trades to prepay for consumption. Owner-occupied housing is mostly consumption, with a little investment layered on top. You don’t see consumers hedging their exposure to gas prices by making elaborate bets on WTI futures, or investing in royalty trusts.[2] You don’t see financial advisors telling bacon lovers to hedge their next thirty years of breakfast consumption with a rolling long position in lean hogs. Only in residential real estate do we tell people to behave this way.

But given the correlation between residential real estate and local labor markets, and the declining geographic mobility of Americans (we’re half as likely as we were a generation ago to move to a new state for work — outrageous!), this is actually the last risk we should hedge this way. Your paycheck is a derivative whose value is partially tied to things within your control, but partially tied to local wages; the way to hedge this bet is to make a floating bet in the opposite direction, i.e. to rent. My wife and I rent right now, and like everyone in New York I face an annual exercise in sticker shock. In the event that markets crater and banks go under, my current rent will be completely unreasonable. But the rent I negotiate the year after that will be very reasonable indeed.

A Bit of History

Why do consumers bet this way? We pay them to: home mortgage interest is very tax-optimized compared to other ways you might borrow money to fund more consumption than you can afford, such as putting a Vegas weekend on your credit card. For lenders, mortgage lending is subsidized through cheap default insurance provided by Fannie Mae and Freddie Mac, (also known as Government-Sponsored Entities — from here on out I’ll call them GSEs).

A mortgage interest tax deduction is one of those policies that makes all the sense in the world unless you think about it for a couple seconds:

- Benefits: The real estate buyer can afford more real estate if they irresponsibly lever up.

- Costs: The price of the real estate rises commensurately.

- Result: Instead of being able to afford only $X worth of property, you can afford, say 1.2 * $X worth of property. Also, 1.2 * $X buys you as much property as $X would have under a different tax regime.

The modern mortgage system came about with the founding of Fannie Mae in 1938. Prior to that, ~55% of Americans rented. Of the Americans who owned homes, most used five-year mortgages, which they’d refinance if necessary at the end of the term. Since five years is a lot closer to the average time someone will occupy a home, especially in a dynamic and growing economy like the one we used to take for granted, this was a good way to structure the market. What Fannie offered was a guarantee to mortgage lenders: if a bank lent money to a homeowner, and that homeowner defaulted, Fannie, not the bank, would make up the loss. Fannie charged a sort of insurance premium for this, but it was a nominal premium — the exact approach was that Fannie bought mortgages from lenders, packaged similar mortgages together, and sold the cash flows of those mortgages. Fannie had a de facto government guarantee for their debt, so their own cost of capital was low; this implicit subsidy allowed them to price insurance cheaply, which in turn meant that the could encourage more lending.

This was one of many New Deal-era experiments in stimulating the economy. And in the 1930s, when output had dropped a lot but debts still had to be serviced, the smart policy for the government was to inject additional liquidity into the system by getting everyone to borrow more. From a macroeconomic perspective, this is reasonable, although I strongly prefer the modern variants.[3]

Encouraging individuals to borrow money to buy houses is hit or miss. Depending on the economic circumstances, it might be a terrible idea, or it might be brilliant.

In the 1930s, it didn’t matter a lot, because there was a depression on; in the 1940s, a war. But from the mid-40s through the next few decades, it was a great idea. Or at least an idea that wouldn’t impose any visible costs for a long time. After the war, some 28% of veterans would avail themselves of subsidized mortgages via the VA. This was due to a confluence of factors:

- Catch-up growth: in the 1930s, we had a huge ramp-up in productivity, but many people were still out of work and unable to participate. In the 1940s, we got our industrial base humming again by cranking out armaments. So by the end of the war, the US was in the same position as a developed nation catching up to the rest of the world: we could just roll out stuff we’d already figured out and see continuous improvements in living standards.

- Male wages were high enough to support a family; female wages were low enough to lower the opportunity cost of family formation. This is the perfect recipe for housing demand; kids are a strong proximate cause for finally saying goodbye to your parents or roommates and getting a place of your own. Gender inequality actually encourages earlier marriage and childbearing since there’s less of a career for mom to give up on. This is self-perpetuating in two ways: first, earlier childbearing means that women are more likely to leave the workforce, which puts pressure on their wages. Second, few double-earner households means less competitive bidding for real estate. Now the norm is either two earners forever or two earners until the couple can afford a down payment and save some more besides; since they’re house-shopping as two full-time earners, this puts housing out of reach of most single-earner households.

- We had a few more years of productivity growth ahead of us. The postwar productivity story is really a story about winning the Cold War by showing off whiz-bang gadgets. The US and USSR had both just demonstrated that they could mobilize for conventional war, and that the limiting factor for both was manpower. That puts them in a game theoretically awkward spot: there’s no way to be more aggressive when you’re already close to maximal aggression — except by demonstrating expertise in un-conventional warfare. So you have things like the space program to showcase our ability to accurately aim missiles containing astronauts, as a way to demonstrate that we can also accurately aim missiles containing, say, a neutron bomb. You have ARPANET, a communications network meant to be robust in case the Soviets shot back. (You may recognize ARPANET as the ancient ancestor of the network via which you’re reading this article.) And there was a boom in communications gadgetry.[4] This Cold War competition paid a peace dividend by subsidizing the development of electronics that had useful civilian applications. And coincidentally, the aerospace industry was concentrated in a few places on the West Coast that were pretty low-density, and could thus support lots of housing-price-accretive population growth.

For a very long period, these forces conspired to make residential lending a very good deal indeed. And while there were pockets of the country where it wasn’t, the overall picture was fine: after the Depression, the housing market almost never dropped on a national level.

America has had a bias towards home ownership for a long time, but some of this is because of our history with the frontier. From a financial standpoint, frontier real estate is cheap because it requires a high risk premium: you literally don’t know if your house is going to be under the jurisdiction of the United States or the Comanches, so the market-clearing price is quite low. As the risk premium declines, the price rises, so sufficiently risk-tolerant individuals can achieve high rates of return.[5] Because of this bias, and because of the general chaos of the Depression, we accepted the idea that subsidizing mortgages was a good approach.

But mathematically, real estate can be a good investment only based on some combination of the following:

- A general increase in rents, which just means an increase in local wages relative to the supply of local housing stock

- An increase in the price to rent ratio

For homeowners, growth in either of these is good. But for everybody else, it’s just redistribution of wealth to homeowners. Arguably, homes were artificially cheap from the 1940s through perhaps the 70s and 80s. But the price appreciation kept happening, so savers kept relearning the lesson that investing in a house (with leverage) is a good way to build wealth. That’s half-right. It was a good way to build wealth when housing was cheap; it’s a good way to destroy it when housing is expensive. Americans are socialized to think that buying a house and getting a mortgage means being a “homeowner,” but the more debt you have and the less means you have to service your debt, the more it’s just way to be a highly leveraged real estate speculator.

When the logic of an investment changes from the ex ante expectation of direct returns (how much housing you get for the cash you spend) to the ex post extrapolation of realized returns (how much money you would have made if you’d put 10% down to buy in this neighborhood ten years ago), prices are no longer anchored to economic fundamentals, so you get a bubble. And a bubble supported by leverage whose cost of funds is only a tiny increment above treasuries is a recipe for disaster.

The Lender’s Perspective

Who supplies the capital for mortgages, and what are they getting out of it?

Obviously they’re getting a return, but why do they invest in mortgages rather than some other asset, and what special considerations do they need to make? This is one of the really interesting aspects of the mortgage market — a financial nocebo that manufactures harmful volatility out of nowhere.

To think about this, you have to think like a fixed-income investor. If you buy bonds, you care about their yield, but you also spend a lot of time thinking about their duration. Duration has two equivalent meanings: it’s a measure of the weighted average time at which an investor receives cash flows, and it’s a measure of the asset’s sensitivity to interest rate changes. Intuitively, an asset that matures next week is pretty insensitive to interest rate changes, whereas for a hundred-year zero-coupon bond, a small change in market interest rates produces a huge change in the value of the bond.

Many fixed-income investors have quantifiable liabilities that also have an expected duration. A pension fund manager, for example, knows the approximate average date on which the fund pays out — if interest rates fall, the present value of the pension’s liabilities rise. So it’s not uncommon for fixed-income investors to run a duration-hedged strategy: if the duration of their liabilities is, say, seven years, then they’ll make sure the duration of their assets is seven years, too, so any change in interest rates affects their assets and liabilities equally.

The mortgage prepayment option does something very interesting to duration: it means that when rates decline, more mortgages get repaid, so duration declines. If you’re an investor, this is the last thing you want. Suppose you’re the investor above, with the seven-year duration liabilities, and you own agency securities (i.e. the mortgage-backed securities issued by Fannie and Freddie). Rates fall, raising the value of your liabilities, and raising the value of your fixed-income assets — except the mortgages. Those get paid down at 100 cents on the dollar; now your assets are less sensitive to rate changes, just when you were benefiting.

The opposite is true as well. People naturally repay their mortgages from time to time, and estimated durations take this into account. But if rates rise, people have an incentive to defer moving: if you’re paying 3.5% and moving means paying 5%, you’re strongly incentivized to stay put. So as rates rise (i.e. the value of fixed income assets declines), duration increases — once again, you’re getting the worse end of the bargain.

This has two effects, the obvious and non-obvious.

The obvious effect is that investors in mortgage-backed securities demand, and get, higher interest rates than they’d get on equivalently creditworthy treasuries. That’s just the market being efficient: borrowers have an option to refinance, they pay for that option in the form of higher interest rates.

The less obvious implication is that agency bond owners who care about duration (that’s going to be all of them, except the Fed) will dynamically hedge their duration risk. If the duration of their portfolio falls, they’ll buy longer-duration securities to raise it, and vice-versa. There are many securities you could buy with long duration, but generally the simplest approach is to buy a security with zero credit risk, denominated in the same currency as whatever you’re hedging. i.e. to buy US treasuries.

So the process goes like this:

- Mortgage rates drop.

- Homeowners prepay their mortgages, shortening the duration of mortgage-backed securities.

- Agency bond owners compensate by buying treasuries.

And just for fun, we will introduce step four: since mortgage rates are benchmarked to treasuries, mortgage rates drop again.

Stepping back a bit, you might ask how this is possible. Derivatives are zero-sum: in theory, if one side has to hedge by buying X, their counterparty should have just as much a reason to hedge by doing the opposite of X.

The problem is one of scale. Agency bonds are owned by pension funds, sovereign wealth funds (China has a bunch), and other large institutions. These organizations can afford to think about things like dynamically hedging duration. Their counterparty is J. Random Homeowner, who is not thinking about duration at all. In an ideal world, every time rates drop homeowners would say “hey! the duration of my liabilities just dropped. Better short some 10-year futures to even things out,” and in that case we wouldn’t have the duration-hedging cycle. But we don’t live in that world. By creating a massive trade (~87% of mortgages are 30-year prepayment option mortgages, and one- to four-family residences have a total of around $10.8tr in mortgage debt outstanding), we’ve caused an artificial increase in the volatility of the ten-year.

And that has profound consequences. The US dollar is the de facto world currency, so the ten-year US Treasury is the benchmark long-term interest rate for everybody, everywhere. Ultimately, every asset gets compared to it, directly or indirectly. So if there’s artificial volatility in the ten-year, there’s artificial volatility in every market.

All this, just so American homeowners don’t have to think about floating-rate debt, a problem so daunting it can only be handled by homeowners in every country in the world except the US and, for some reason, Denmark.

The GSEs and Agency Debt: Even Worse Than Meets the Eye

The GSEs, Fannie Mae and Freddie Mac, played and play a crucial role in residential housing finance.

There’s a classic pattern in finance that goes like this: a company starts making a particular kind of loan. The loan performs well, so the company makes more loans. Eventually, there’s competition, and profitability declines; rather than accept that the easy-money era is over, the company maintains its returns on equity by increasing its leverage. Then, when the market turns, the company goes bankrupt and sanity is restored.

The story of Fannie and Freddie is sort of like that, except that after going bankrupt they kept doing what they’d been doing all along, and actually gained share. It’s a financial zombie flick.

Fannie and Freddie never quite fit the general financial services narrative. They were both able to borrow at low rates due to an implicit government guarantee, and both started out as government agencies. (Fannie was formally turned into a for-profit company with a listed stock in the 60s, because of the risk that their liabilities would be listed on the government’s balance sheet — a plot point that we’ll come back to later.) Freddie was founded in 1970, as a competitor, but it has approximately the same charter as Fannie, and offers the same services. Also it was and is implicitly backed by the same national government. So Fannie and Freddie are rivals in the same sense that Hulk Hogan and Andre the Giant were mortal enemies.

Fannie and Freddie had two businesses: buying mortgages, packaging them, and selling them to investors (that is, converting a bunch of individual mortgages into Agency Debt, and placing the debt), and buying the mortgages directly. In both of these businesses, they were seriously undercapitalized. For every dollar of capital they had in the direct business, Fannie and Freddie could own $40 worth of mortgage assets. (They did the prudent thing here and hedged their interest rate risk, so they were really speculating on the creditworthiness of borrowers. But that’s a lot of speculation!)

In the agency debt business, their capital requirement was 45 basis points. To guarantee a $100,000 30-year mortgage, Fannie and Freddie needed $450 on the books. Economically, there’s not a big difference between owning an asset (and being directly on the hook for all losses) and guaranteeing it, which also puts you on the hook for losses. The result, in the crisis, was basically:

In the runup to the crisis, they expanded their mandate in two directions: first, they allowed homeowners to cash out more equity, rather than buying new houses. Home equity cashouts were $966bn from 2004 to 2007, and in 2006 cash-out refinancings were 30% of all refinancings at Freddie Mac.

In 2008, they both started massively writing down their mortgage positions, and quickly reached insolvency. So, like many institutions in 2008, they got bailed out. Their bailout was structured a little differently, though: the government offered them a practically unlimited line of credit in exchange for the right to buy about 80% of their shares outstanding and a high-dividend preferred stock. Later, they changed the terms of this preferred stock to entitle the treasury to all of Fannie and Freddie’s profits.

This is an economic structure that doesn’t particularly make sense: Fannie and Freddie are in the business of using the government’s implicit guarantee as a source of cheap capital; they borrow cheaply and lend not-so-cheaply, and pocket the difference — or used to. Now, the US Treasury pockets the difference. So, economically, what happens is that the US government issues debt, buys mortgages, and turns a profit on the gap. As far as anyone knows, the reason the deal’s legal structure doesn’t match that accounting structure is that Fannie and Freddie have a lot of debt, and the government doesn’t want to consolidate it on their balance sheet. So Fannie and Freddie are a highly-levered off-balance-sheet structured credit play. This is giving me nostalgia for 2007.

Timeline of the crisis:

2007-Summer 2008: Rumblings at the periphery of the financial system. Special-purpose entities and complex real estate-based derivatives are introducing systemic risk.

August-September 2008: These risks come home to roost during the largest financial crisis since the Great Depression. We learn a lesson we’ll never forget.

September 6, 2008: Fannie and Freddie are placed into conservatorship. Having forgotten the lessons of the Great Financial Crisis, we structure the deal so the buyer (the US Government) gets to keep a lot of risk off its balance sheet, even though economically they’re still completely on the hook.

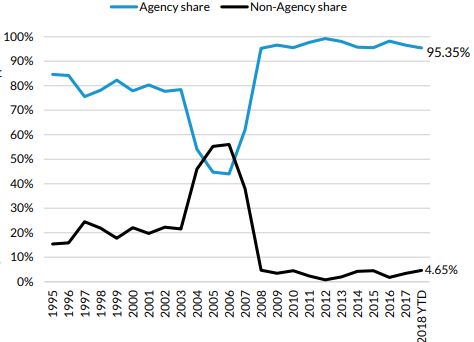

Incredibly, after the crisis, Fannie and Freddie’s market share in mortgage securitizations went up. Private-label securities went from 42% of the market in 2006 to 1.2% in 2015. Now agency debt is around 95%:

There is a counterargument to my incredulity, here. It goes like this: yes, Freddie and Fannie wrote down a bunch of debt, and quickly reached insolvency. But they later wrote that debt back up! And their loans actually outperformed the competition. In other words, they underwrote responsibly. There are two problems with this: 1) If a company makes levered bets on financial assets, there is no meaningful sense in which they can be “temporarily” insolvent. A financial company doesn’t have a safe balance sheet unless its leverage is acceptable under extreme circumstances. 2) The fact that the GSE didn’t go under when they took enormous writedowns is itself a form of subsidy. Essentially the GSEs got a free CDS contract on their own debt.

Call it the Value At Risk of Dorian Gray: the worse the mortgage market got in 2008, the more of a role Fannie and Freddie played in creating mortgages — which put a bid under housing and thus reduced defaults in their own portfolio. Proponents of the GSEs note that while the GSEs wrote their assets down to the point of insolvency during the crisis, realized losses were lower; they wrote stuff back up eventually. But that’s an appallingly irresponsible argument. Anyone can make money on levered bets if the loans never get called in. Here’s a surefire strategy: lever up 20 to 1 in equity index futures. When you get a margin call, let it go to voicemail. Historically, stocks have always gone up eventually, and with 2,000% leverage you can make a lot fast. What Fannie and Freddie were doing was artificially encouraging bids for the collateral they’d lent against. And that does prevent defaults, assuming you have unlimited financial firepower. But if you had unlimited financial firepower, why on earth would you use it to keep making bad loans? The more precise Fannie/Freddie version of that levered strategy is: if you lose money, write at-the-money puts on the index at such a huge scale that, for investors, going long is essentially free. Given unlimited capital, it would work.

The whole point of risk management in levered institutions is that you have to ensure that, in a worst-case scenario, you can still roll your short-term debt, i.e. you never reach the point where you literally can’t pay the bills. If you do reach that point, it doesn’t do anybody any good to point out that you’ll eventually be solvent again. “I’ll be solvent in a few years if I don’t have to pay my debts now” is just another way of saying that if your business becomes insolvent and liquidates, the buyers get a good deal. And we already know that happens after a market break.

We will never know what the “natural” decline in real estate prices would have been, but the GSEs’ post-crisis share is suggestive: it’s likely that there was no investor appetite for real estate even at levels far below the crisis lows, so the GSEs were even more insolvent than they appeared at the lows.

Fannie’s latest 10-K shows that of the $4.9bn in net writeups of formerly-distressed debt Fannie has done in the last three years, $6.3bn can be attributed to housing price appreciation. Freddie doesn’t break out the numbers the same way, but given the similarities between the two, it’s likely that Freddie is also a levered long bet on housing price appreciation. For prior years, Fannie also doesn’t quantify it, but in earlier years their discloure around changes in credit losses still leads with asset price changes. (“We recognized a benefit for credit losses in 2014 primarily due to increases in home prices of 4.7% in 2014.” “The following factors contributed to our benefit for credit losses in 2013: Home prices increased by 8.8% in 2013 compared with an increase of 4.2% in 2012.”) So the GSEs are still fundamentally making a bet that housing will go up.

The CBO estimates the size of the GSEs’ subsidy at around $1.6bn per year, but this appears to be a gross underestimate, both from a sanity-checking perspective (they previously said mortgage rates would be 60 bps higher, or $65bn per year assuming $10.8 trillion mortgages, which is a good lower bound for the actual size of the subsidy) and because of the distortive effects of the GSEs themselves.

It’s a lower bound, though, because the cost of making good on the guarantee is dependent on the volatility of residential real estate, but the guarantee itself reduces the amplitude of changes in housing prices. Fannie and Freddie provide a disproportionate share of liquidity during crises, because they’re comparatively risk-insensitive, and when credit spreads widen, their implicit guarantee lowers their relative cost of capital.[6]

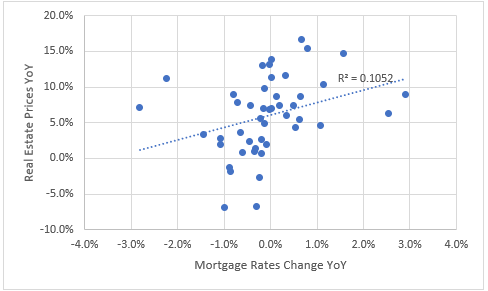

When the CBO talks about unwinding Fannie and Freddie, they argue that a 60 bps increase in mortgage rates is not a big deal, because historically mortgage rates don’t correlate that well with housing prices. I beg to differ: mortgage rates don’t correlate because the credit spread is artificially compressed by the GSEs, so a “mortgage” rate in the US is basically a spread on a treasury. And treasury rates are counter-cyclical. As a matter of fact, the CBO is historically correct: there is a positive correlation between changes in mortgage rates and housing prices, albeit a weak one:

It’s nontrivial to find variables that predict housing prices, because the GSEs make mortgage availability a macroeconomic tool. Anything fundamental change that should cause housing to drop in price (a supply shock, a demand shock, a crash in a different market) will tend to lower rates and thus subsidize housing.

We don’t just underestimate the risks GSEs run or the cost of keeping them alive. We also overestimate their usefulness.

Part of the reason GSEs exist is to help low-income homeowners get access to financing. The GSEs have benchmarks for this. For example, Fannie needs to make 24% or more of their loans to borrowers whose income is below 80% of the area’s median income. Even for a government anti-poverty program, this is pathologically bad. A house is an illiquid asset whose value is mostly tied to local labor markets. You want people with low incomes to borrow money to double down on this!? Here’s what will happen: when the one big factory in a one-factory town closes, everybody who rents will leave. Real estate prices will plummet, so everybody who bought a house with a 10% down payment will lose their biggest asset and probably have a negative net worth.

If anything, our policy should do the opposite of what the GSEs promote: if you have a low income, and you try to borrow money to buy a house near where you work, there should be a surtax to discourage this bad diversification. There are other savings vehicles that don’t closely correlate with your income; buy those instead!

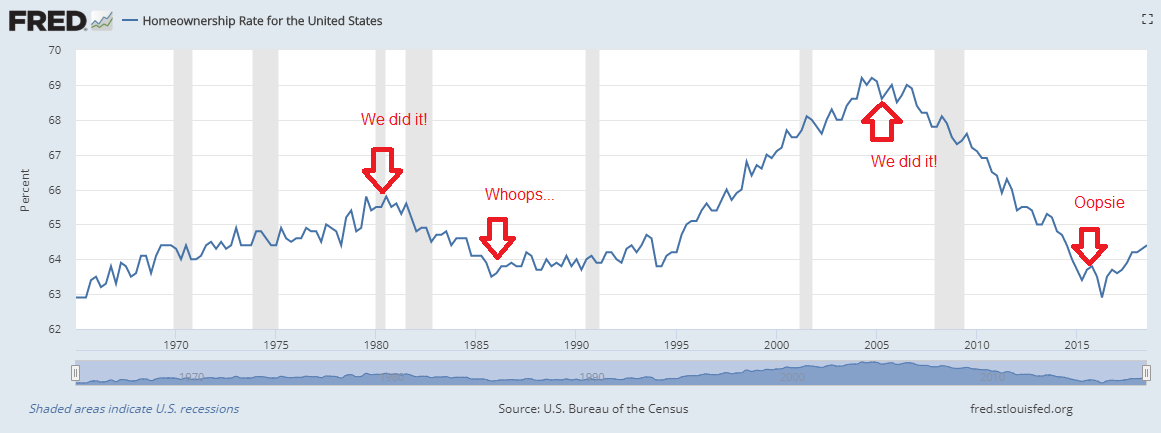

The other policy purpose the GSEs serve is to raise home ownership. This they do, although home ownership rates today are around 64%, which is where they were in the mid-90s, the mid-80s, and the late 60s. We may have reached the point where we can maintain artificially high home ownership rates through continued subsidies, but we can’t push them up much more without causing a bubble.

Interestingly, a high rate of home ownership, coupled with lots of prepayable mortgage debt, creates a novel channel for monetary stimulus: when the Fed lowers rates, it pretty much automatically lowers mortgage rates (thanks to GSEs, the credit spread is static). This makes mortgages a countercyclical stabilizer: during good times, rates are high, so people don’t refinance as much; when rates rise, mortgage holders get more cash flow. However, the spending multiplier on this cash is not especially high: for heavily indebted homeowners who have lost their jobs, a cheaper mortgage just means slightly less cash leaving the door every month; their spending is presumably about as low as it can be already. For the very rich, a mortgage is a small proportion of their assets; they have more money in equities, which usually do worse than real estate during a recession. The group that ends up better-off is the middle class. But on the margin, they tend to spend money on things like education, healthcare, and more housing — all fairly low-productivity sectors that have had high inflation in recent decades, with little improvement in quality. From a macroprudential perspective, a better policy would be to distribute cash directly to poor people who don’t have large mortgage debts, since they’d spend it right away and help boost consumption.

Instead, we’re stuck with a weird and crippled financial system that makes it relatively hard to inject lots of liquidity without setting off a bubble in property, as we learned to our chagrin while trying to recover from the post-90s hangover.

What to Do About It

For the individual, the fact that encouraging 30-year mortgages is a bad policy does not imply that getting one yourself is a bad deal. The policy wouldn’t be bad if it weren’t effective, and it’s only effective to the extent that it encourages people to actually get the loans. So while I think there are prudent asset allocation reasons to favor renting over buying, if you don’t buy into those a standard mortgage is a relatively tax-efficient way to pay for housing.

From a policy standpoint, the picture is murky as well. Since 2008 didn’t kill the 30-year, you could argue that it will never die. But I’m not so pessimistic: the next few years give us the first opportunity in decades to ween ourselves off our 30-year mortgage addiction. Right now we’re running a fairly expansionary fiscal policy and a relatively contractionary monetary policy. This combination means that mortgage holders don’t have strong reasons to refinance, but they’re not financially stressed. So of all the times that we could start ramping down subsidies to residential housing, this is one of the safest.

The upshot of this perspective is non-obvious. Bubbles grow by increments but deflate catastrophically, and it’s hard to deflate one by policy. In theory we could try to sunset the GSEs: give them thirty years to slowly wind down their books while offloading the underwriting and guaranteeing business to somebody else. But in practice the consequence of any reform is some combination of a) a large drop in housing prices, which has a catastrophic wealth effect on the middle class, or b) a subsidy that replicates the status quo. Anything that eliminated the GSEs and didn’t cause any home price drop would have to be functionally equivalent to them.[7]

And suppose we did pass a law that slowly sunsetted the GSEs. That gives them thirty years to save their jobs. As I mentioned above, the sheer number of people involved gives these companies ample lobbying and political power. The majority of the electorate owns homes, i.e. we live in a country where most of the electorate benefits from subsidies to real estate speculation. So we should assume that the standard political process will protect the status quo indefinitely.

But we can fantasize a bit. A real solution to the distortive effects of our current mortgage system would be pretty radical. On the other hand, it’s already quite radical for the US to have pseudo-nationalized two multi-trillion dollar financial institutions, and to use them to subsidize speculation. So really it’s a choice between the radicalism we know (and dislike) and the sort we don’t. A rough outline of how we could go about unwinding the GSEs: distribute the treasury’s stock (perhaps the treasury could “mutualize” the GSEs and distribute shares to agency debt owners), immediately declare that future GSE debt will not be backed by the US government — create rules for treasury disbursements that explicitly block this, and prepare to print dollars. Eliminating the GSE guarantee means eliminating cheap long-term mortgages, which would reduce housing prices. While that’s what we want on average (i.e. to say that housing is artificially expensive is to say that it should be cheaper), the direct economic effect would be painful. To counteract it, the treasury could print additional dollars and buy safe assets or just distribute cash to taxpayers, targeting steady growth in nominal GDP. This would result in near-term disruption to consumers, deflation in real estate prices, and inflation in everything else.

In other words, it would look exactly like the playbook that every other country with a real estate bubble uses: once the bubble pops, devalue the currency to maintain real growth. The only difference is that in this case, the bubble-popping is done manually, so the stimulus spending can be lined up in advance. Plenty of other countries had bubbles that ultimately ended up driven by real estate: Spain and Ireland in the 2000s; Thailand, Malaysia, and Indonesia in the 90s, Japan in the 80s. In every case, devaluation has ultimately been the best choice.

In the meantime, for investors and economists there is a clear takeaway. Due to some poorly-considered choices we made in 1938 and never bothered to fix:

- Long-term interest rates are more volatile than they should be, and are a misleading indicator of economic activity and investor sentiment;

- Individual savers in the US are overweight residential real estate compared to other asset classes, so US consumption growth is strongly tied to real estate;

- The main channel by which monetary stimulus turns into higher consumer spending is through solvent homeowners deciding to spend more money — so when we cut rates, we get more of what the upper middle class likes to buy (healthcare, education, and more houses); and

- The US labor market is artificially immobile during recessions (exactly when mobility matters the most).

All of this means that our efforts to stabilize markets have introduced artificial volatility at the margins. And while volatility is rarely pleasant, volatility that you understand better than average is a source of opportunities.

Further Reading

Some works I found useful:

- Shaky Ground is a quick read, mostly focused on the post-crisis legal quagmire around the GSEs.

- Even though they’ve been socialized, part of the book-cooking chicanery around the GSEs entails that they remain public, and continue to file 10-Ks. Here’s Fannie and here’s Freddie. You’ll laugh, you’ll cry, you’ll wonder why this could possibly be the correct approach.

- This dissertation by Sarah Lehman Quinn is a very good overview of the history of US housing policy, which puts many of this century’s developments in context. It closes with a revisionist view of the accounting reasons for Fannie’s privatization.

- Laurie Goodman at the Urban Institute does some great work on this beat. Her reports are a good source for up-to-date data on the mortgage market and the role of GSEs.

Byrne Hobart

Byrne Hobart